Singapore Sovereign Wealth Fund buys majority stake in Greece’s Sani Resort / Ikos Group

- NavInvestGreece

- Sep 21, 2022

- 1 min read

Press reports have announced that Singapore’s sovereign wealth fund GIC is investing in the Sani / Ikos Group as a majority shareholder. The transaction values the company at € 2.3 billion.

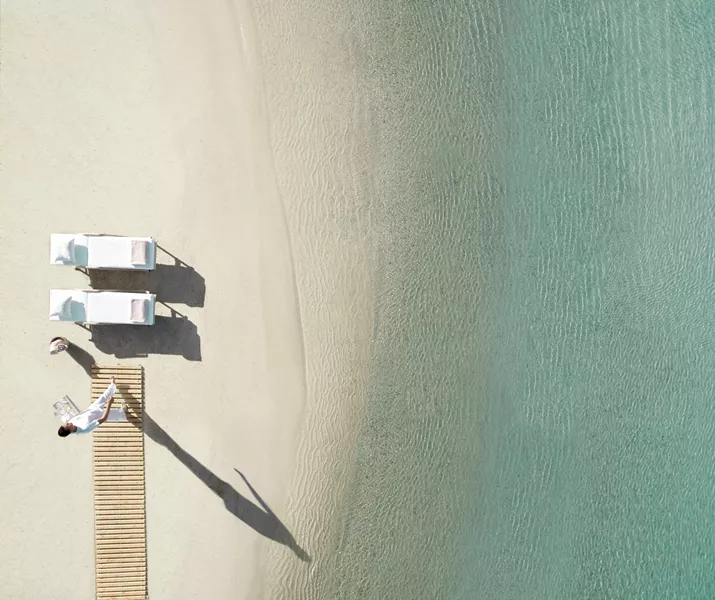

Sani Resorts was established by the Andreadis Family and gradually transformed into a leading high-end resort through years of investment and commitment to quality. The Sani Resort includes 1000 acres of beachfront land in Kassandra, Halkidiki. It includes a collection of hotels, a marina, and over 7 km of coastline.

The Ikos Group was launched in Greece by Oaktree Capital Management as a 5* ultra all inclusive concept.

The two groups merged in 2015, and gained further backing from Oaktree, Goldman Sachs Asset Management, Moonstone and others.

GIS has committed to a further investment of € 900 million to further expand the business within 5 years.

The Sani / Ikos Group currently owns and operates 10 resorts with over 2,750 rooms in Greece and Spain. It has four new projects under development which will bring an additional 1,578 rooms and villas to market once completed.

Greece is attracting major investments in its hotel and wider tourism sector, and in 2022 is expected to surpass 2019 arrivals and revenue, despite the war in Ukraine, sanctions on Russia and high inflation.

For further insights into Greek hotel and tourism investments, please contact us in full confidence.

All photos (c) Sani Resort.

Comments